Article

The Innovator’s Trap: Balancing Creativity and Execution in Startups

July 25, 2024

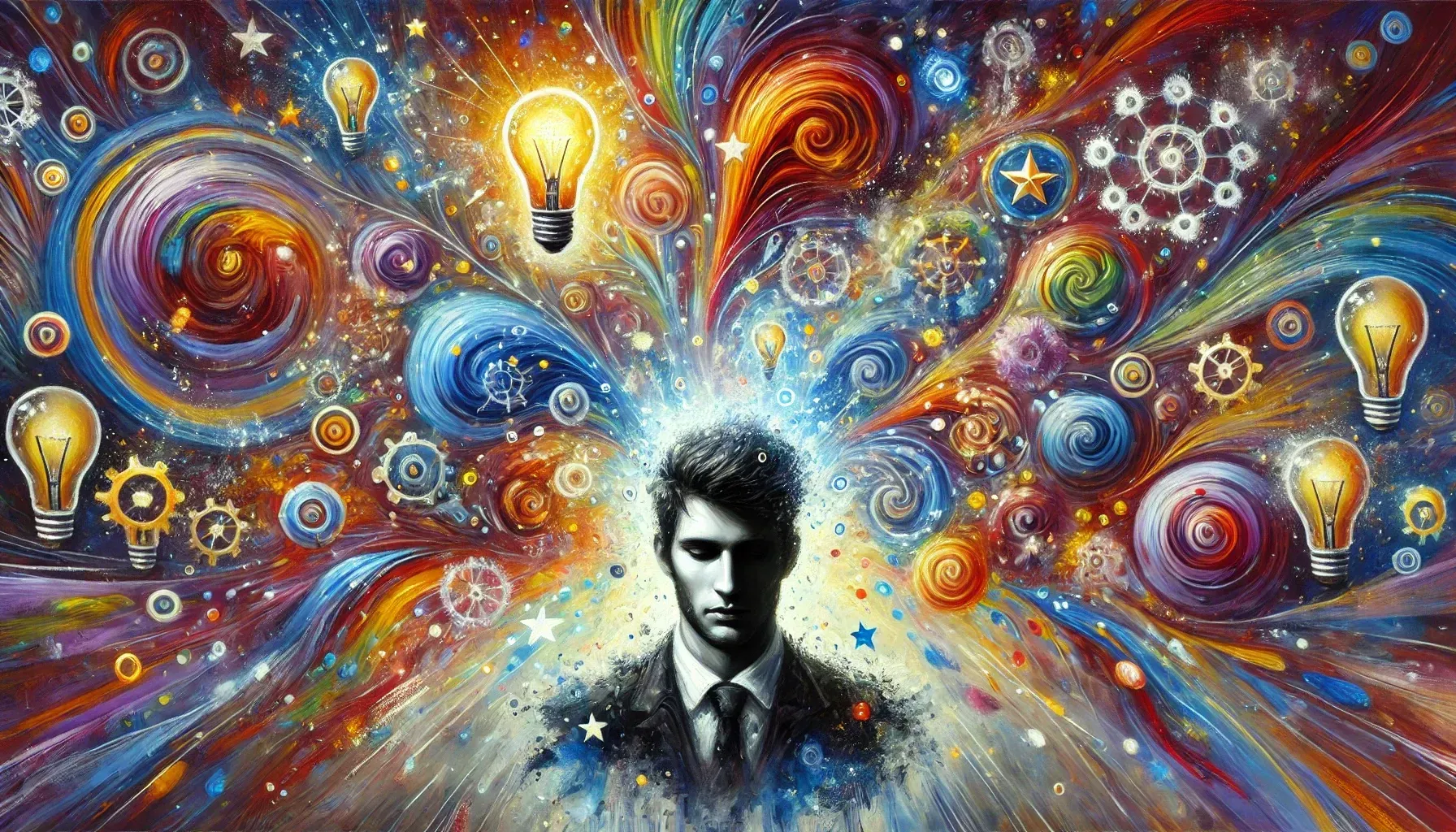

Startups are born from big ideas and bold visions. Founders are often celebrated as innovators, individuals who can see what others can’t and create what hasn’t been created before. Innovation is the lifeblood of a startup, driving it forward and setting it apart from competitors. However, there’s a hidden danger in this relentless pursuit of innovation—a trap that can ensnare even the most brilliant founders. This is the innovator’s trap: the peril of focusing so much on creating that execution falls by the wayside.

The Allure of Constant Innovation In the early stages of a startup, innovation is everything. It’s what attracts initial investors, draws in early adopters, and generates buzz. Founders spend countless hours brainstorming, iterating, and refining their ideas. The excitement of creating something new fuels long nights and relentless work.

This focus on innovation is crucial at the outset. It’s what allows startups to disrupt established markets and offer unique value propositions. Founders who can dream big and think differently are able to carve out niches in even the most competitive industries. However, as the startup begins to grow, the constant drive to innovate can become a double-edged sword.

When Innovation Becomes a Liability The innovator’s trap occurs when the obsession with creating new things overshadows the need to execute effectively. Founders may find themselves perpetually chasing the next big idea, constantly pivoting and tweaking, but never settling on a concrete plan of action. This endless cycle of innovation can lead to several problems.

First, it creates a lack of focus. With so many ideas in play, it becomes difficult to prioritize and execute on the most critical tasks. Resources are spread thin, and the team may feel pulled in too many directions. This can lead to burnout and frustration, as progress seems slow and fragmented. Second, it hampers execution. Great ideas are worthless without effective implementation. A startup that is constantly innovating but failing to execute will struggle to grow and scale. Customers may become frustrated with unfinished or perpetually changing products, and the company’s reputation can suffer as a result.

Third, it can alienate the team. While founders may thrive on the chaos of constant innovation, team members might not share the same appetite for uncertainty. The lack of clear direction and achievable goals can lead to disengagement and high turnover, undermining the company’s ability to build a cohesive and productive team.

Balancing Innovation with Execution: Key Strategies To avoid the innovator’s trap, founders must learn to balance their creative impulses with the practical demands of running a business. Here are some strategies to achieve this balance:

The Path to Sustainable Innovation Innovation is the engine that drives startups, but without effective execution, even the most brilliant ideas will fail to take off. By learning to balance creativity with practical implementation, founders can avoid the innovator’s trap and set their companies on a path to sustainable success.

The most successful startups are those that can dream big while also executing meticulously. They understand that innovation and execution are not mutually exclusive but are instead two sides of the same coin. By fostering a culture that values both, founders can ensure that their companies continue to innovate while also delivering on their promises.

In the end, the true mark of a successful innovator is not just the ability to come up with great ideas but also the ability to bring those ideas to life. Avoiding the innovator’s trap means embracing the dual role of creator and executor, and in doing so, paving the way for long-term growth and success.

The Allure of Constant Innovation In the early stages of a startup, innovation is everything. It’s what attracts initial investors, draws in early adopters, and generates buzz. Founders spend countless hours brainstorming, iterating, and refining their ideas. The excitement of creating something new fuels long nights and relentless work.

This focus on innovation is crucial at the outset. It’s what allows startups to disrupt established markets and offer unique value propositions. Founders who can dream big and think differently are able to carve out niches in even the most competitive industries. However, as the startup begins to grow, the constant drive to innovate can become a double-edged sword.

When Innovation Becomes a Liability The innovator’s trap occurs when the obsession with creating new things overshadows the need to execute effectively. Founders may find themselves perpetually chasing the next big idea, constantly pivoting and tweaking, but never settling on a concrete plan of action. This endless cycle of innovation can lead to several problems.

First, it creates a lack of focus. With so many ideas in play, it becomes difficult to prioritize and execute on the most critical tasks. Resources are spread thin, and the team may feel pulled in too many directions. This can lead to burnout and frustration, as progress seems slow and fragmented. Second, it hampers execution. Great ideas are worthless without effective implementation. A startup that is constantly innovating but failing to execute will struggle to grow and scale. Customers may become frustrated with unfinished or perpetually changing products, and the company’s reputation can suffer as a result.

Third, it can alienate the team. While founders may thrive on the chaos of constant innovation, team members might not share the same appetite for uncertainty. The lack of clear direction and achievable goals can lead to disengagement and high turnover, undermining the company’s ability to build a cohesive and productive team.

Balancing Innovation with Execution: Key Strategies To avoid the innovator’s trap, founders must learn to balance their creative impulses with the practical demands of running a business. Here are some strategies to achieve this balance:

- Prioritize Ruthlessly:

- Not all ideas are created equal. Founders need to develop a framework for evaluating and prioritizing ideas based on their potential impact and feasibility.

- Focus on the initiatives that align most closely with the company’s strategic goals and have the highest likelihood of success.

- Set Clear Goals and Milestones:

- Establishing clear, achievable goals helps maintain focus and ensures that the team is working towards common objectives.

- Break down larger projects into manageable milestones, and celebrate progress along the way.

- Build a Culture of Execution:

- Encourage a culture that values execution as much as innovation. This means recognizing and rewarding team members who excel at implementing ideas and driving projects to completion.

- Foster an environment where execution is seen as a critical component of the company’s success.

- Create Structured Processes:

- Implementing structured processes can help manage the flow of ideas and ensure that they are developed and executed systematically.

- Use project management tools and techniques to track progress, allocate resources, and keep the team aligned.

- Maintain Flexibility Without Losing Focus:

- While it’s important to remain flexible and open to new ideas, founders must also be disciplined about sticking to the plan.

- Regularly review and adjust the strategic plan as necessary, but avoid constant pivots that disrupt progress.

The Path to Sustainable Innovation Innovation is the engine that drives startups, but without effective execution, even the most brilliant ideas will fail to take off. By learning to balance creativity with practical implementation, founders can avoid the innovator’s trap and set their companies on a path to sustainable success.

The most successful startups are those that can dream big while also executing meticulously. They understand that innovation and execution are not mutually exclusive but are instead two sides of the same coin. By fostering a culture that values both, founders can ensure that their companies continue to innovate while also delivering on their promises.

In the end, the true mark of a successful innovator is not just the ability to come up with great ideas but also the ability to bring those ideas to life. Avoiding the innovator’s trap means embracing the dual role of creator and executor, and in doing so, paving the way for long-term growth and success.

share this

Related Articles

Related Articles

The Leadership Tightrope If you lead long enough, you start to realize something uncomfortable: everything that makes you effective also threatens to undo you. Your drive becomes impatience. Your confidence becomes stubbornness. Your empathy turns into guilt. The longer you lead, the more you realize that the job isn’t about choosing one trait over another — it’s about learning to carry both. That’s what maturity looks like in leadership. It’s not balance. It’s tension well managed. The False Comfort of Either/Or Most leaders crave clarity. We want rules. Playbooks. Certainty. Should I be tough or kind? Decisive or collaborative? Visionary or practical? The insecure part of the brain hates contradiction. It wants the “right answer.” But leadership lives in the messy middle — the place where both truths exist, and neither feels comfortable. The best leaders aren’t either/or thinkers. They’re both/and navigators. A Story from the Field I once coached a CEO who told me, “I’m torn between holding people accountable and being empathetic.” I said, “Why do you think those are opposites?” He paused, then laughed. “Because it’s easier that way.” Exactly. It’s easier to pick a lane than to learn how to drive in two at once. He eventually realized the real question wasn’t which side to choose, but when and how to lean into each. He became known as “the fairest tough boss in the building.” That’s the magic of integration — toughness with tenderness, vision with realism, clarity with compassion. Why Paradox Feels So Hard Contradictions feel like hypocrisy when you haven’t made peace with your own complexity. If you believe you have to be one consistent version of yourself — confident, decisive, inspiring — then every moment of doubt feels like fraud. But the truth is, great leaders are contradictory because humans are contradictory. You can be grounded and ambitious, humble and proud, certain and still learning. The work is not to eliminate the tension — it’s to get comfortable feeling it. The Psychology Behind It Our brains love binaries because they make the world simple. But complexity — holding opposites — is the mark of advanced thinking. Psychologists call this integrative complexity — the ability to see multiple perspectives and blend them into a coherent approach. It’s not compromise; it’s synthesis. It’s saying, “Both are true, and I can move between them without losing my integrity.” That’s where wisdom lives — in the movement, not the answer. Funny But True A client once told me, “I feel like half monk, half gladiator.” I said, “Congratulations. That means you’re leading.” Because that’s what the job demands: peace and fight, compassion and steel. If you can’t hold both, you end up overusing one until it breaks you. The Cost of One-Dimensional Leadership We’ve all worked for the “results-only” leader — brilliant, efficient, and emotionally tone-deaf. And the “people-first” leader — kind, loyal, and allergic to accountability. Both are exhausting. Both create lopsided cultures. When leaders pick a single identity — visionary, disciplinarian, nurturer, driver — they lose range. They become caricatures of their strengths. True greatness comes from emotional range, not purity. The Paradox Mindset Here’s how integrative leaders think differently: They value principles over preferences. They can be decisive without being defensive. They know empathy isn’t weakness and toughness isn’t cruelty. They trade perfection for adaptability. They’re the ones who can zoom in and out — from the numbers to the people, from the details to the meaning — without losing coherence. They’re not consistent in behavior. They’re consistent in values. That’s the difference. How to Practice Both/And Thinking Spot your overused strength. The strength that’s hurting you most is the one you lean on too much. If you’re decisive, try listening longer. If you’re compassionate, try being direct faster. Ask, “What’s the opposite quality trying to teach me?” Impatience teaches urgency; patience teaches perspective. You need both. Invite your opposite. Bring someone onto your team who balances your extremes — not a mirror, a counterweight. Hold paradox out loud. Tell your team, “This decision has tension in it — and that’s okay.” Modeling that normalizes complexity for everyone else. A Moment of Self-Honesty I’ve spent decades watching leaders chase “clarity” like it’s peace. But peace doesn’t come from eliminating tension. It comes from trusting yourself inside it. Once you accept that leadership will always feel contradictory, you stop fighting it — and start flowing with it. You don’t need to be the calmest, toughest, or most visionary person in the room. You just need to be the one who can stay whole while the world pulls you in opposite directions. Your Challenge This Week When you catch yourself thinking, “Should I be X or Y?” — stop. Ask instead, “How can I be both?” Then practice it in one small moment. Be kind and firm. Bold and humble. Fast and thoughtful. That’s where growth hides — in the discomfort between two truths. Final Word The best leaders aren’t balanced. They’re integrated. They’ve stopped trying to erase their contradictions and started using them as fuel. They’ve learned that leadership isn’t about certainty. It’s about capacity — the capacity to hold complexity without losing your center. That’s not chaos. That’s mastery

STAY UP TO DATE

GET PATH'S LATEST

Receive bi-weekly updates from the church, and get a heads up on upcoming events.

Contact Us